Charity Events

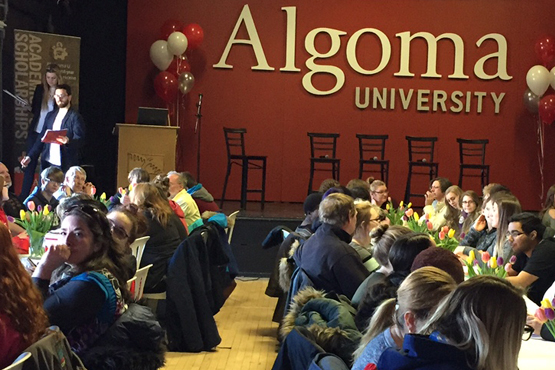

The John R. Rhodes Scholarship Dinner

The John R. Rhodes Scholarship was established in 1979 through generous donations from friends and family of the late John Rhodes.

This is the most prestigious scholarship offered annually to an Algoma University student entering their first year of university studies at the Sault Ste. Marie campus, from secondary school who has demonstrated academic achievement and community leadership while involved in political, social, or academic activities.

Algoma University Classic Golf Tournament

The Algoma U Classic Golf Tournament is one of Algoma University’s premier fundraising events.

A day on the golf course is a great day “fore” education while supporting Algoma University. Our last tournament in 2023 raised $30,000 to the Student Relief Fund. Since its inception, it has raised over $555,000 for Student Scholarships and Bursaries. The generosity of our sponsors and participants has been the key to our success.

The 2024 Algoma University Classic Golf Tournament will be held at Sault Ste. Marie’s beautiful Crimson Ridge Golf Course – Date: June 27th, 2024.

If you are interested in sponsoring next year’s tournament, please contact Logan Costa, Senior Development Officer, at [email protected] or 705-949-2301 ext. 4240.

Algoma University Gala 2023

This was a memorable evening where we celebrated incredible milestones and showcased our innovative vision for the future.

A new scholarship has been established to help equity-deserving students in Brampton, which will help to remove financial barriers. Click here to donate now and continue the support.

Giving Opportunities

Student Relief Fund

Our top priority is the success of our Algoma U students. A new Student Relief Fund has been established at Algoma University to assist students unable to cover urgent, essential expenses due to a crisis. A variety of expenses will be covered by the Student Relief Fund, including: transportation and housing needs, childcare support, technology needs, financial support due to job loss while seeking new opportunities, and support for food costs due to rising price increases.

FIND OUT MORE

Scholarships & Bursaries

Algoma University’s scholarship program attracts the best and the brightest students by recognizing their academic excellence. Gifts to the Annual Fund provide Entrance Scholarships to high school graduates and college transfer students who have demonstrated academic excellence. These scholarships are carried forward through to graduation for students who maintain their academic achievements. Bursaries help ensure that post-secondary education is accessible to all students regardless of their financial resources. Each year over $200,000 in scholarships and bursaries are awarded to qualifying students.

FIND OUT MORE

Annual Fund

The Algoma University Annual Fund exists to support our students’ success. Generous gifts to the Annual Fund from alumni, staff, faculty, parents, community partners and friends are an important expression of support. Your gift to the Algoma University’s Annual Fund helps to create new opportunities for our students.

FIND OUT MORE

Arthur A. Wishart Library

The Arthur A. Wishart Library collection and services support Algoma University’s academic programs. Library resources comprise of more than:

- 500,000 scholarly e-books

- 100,000 scholarly print books

- 116,000 scholarly e-journals

- 300 scholarly print journals

- 93,000 music recordings

- 325 linear metres of archival holdings searchable at archives.algomau.ca

Gifts to the Arthur A. Wishart Library, including in-kind donations such as rare books and archives, will be used to enhance the collection of research and resource materials and the facilities available to students.

FIND OUT MORELeave a Legacy

Planning gifts of charity ensures that the causes and organizations that you have deemed important during your lifetime continue to benefit from your support in perpetuity.

Gifts of charity may be given through:

Your will is an important legal document that allows you to continue to care for the people, causes and interests that have mattered most to you during your lifetime. A bequest to Algoma University will provide acknowledgement of the importance you have placed on post-secondary education. Your memory will live on in perpetuity through your gift and will help students in years to come.

A bequest is a planned gift made through your will which provides you with the opportunity to make a substantial gift to Algoma University in the future without diminishing your assets today. Your legacy lives on through your bequest and your estate can benefit from considerable tax savings. Gifts made through your will provide charitable tax credits that can offset taxes owed that would otherwise diminish the value of your estate.

With a bequest of $20,000 or more, you can create an endowed fund that will benefit Algoma University in perpetuity.

There are different types of bequests to consider:

- A general bequest allows you to designate a specific amount of money to Algoma University.

- A residual bequest allows you to direct all or a percentage of the remaining estate to Algoma University, after debts and other bequests have been paid.

- You may choose to make a specific bequest to Algoma University. Bequests can also be made in the form of stocks.

- A contingent bequest is a gift that is left to a secondary beneficiary. If the first beneficiary is unable to receive the gift, it is directed accordingly to the secondary beneficiary.

Contact your professional advisors to learn more about designating Algoma University as the beneficiary of your estate and to determine if this option is appropriate for you.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

A gift of life insurance may be an appropriate option for you to make a significant and lasting gift to Algoma University. There are many types of insurance policies and not all are appropriate for charitable giving therefore it is best to contact your licensed insurance broker to discuss the best option for you.

A planned gift through a life insurance policy, directed to Algoma University, is a deferred gift. The commitment you make today will be realized in the future.

The advantages of making a gift through a life insurance policy include:

- The ability to make a significantly larger gift to Algoma University at very little cost to you.

- Tax benefits that can include either an immediate tax credit or a tax credit in the year of death.

- A gift through life insurance will not reduce the value of your estate to your heirs and will not be subject to estate taxation.

There are a number of options available for making a gift through an insurance policy. You should discuss the options with your licensed insurance broker to determine which one is best for you.

Options

- Purchasing a new policy.

You can name Algoma University as the irrevocable owner and beneficiary of the policy. You receive an income tax receipt for the full amount of the premiums paid. Your gift creates a significant legacy for you, at an affordable cost.

- Donating an existing policy.

Many people have old insurance policies that are paid which they no longer require. You can donate an existing policy to Algoma University by transferring the ownership or making Algoma University the beneficiary of the policy. It is a wonderful way to use a policy that may no longer be of use to you and make a significant gift that will impact the lives of students.

- Making Algoma University the Beneficiary of a new or existing policy.

Reviewing your estate planning may provide you with a cost-effective way of reducing your estate taxes. Assigning the beneficiary status of an existing or new policy to Algoma University may be an option you want to consider.

Contact your professional advisors to determine if this option is appropriate for you.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

Naming Algoma University as the beneficiary of your RRSP or RRIF can save your family and your estate significant tax savings. A charitable tax credit would offset taxes owed and since the funds would not pass through your estate, they would not be subject to probate and other estate costs.

Contact your professional advisors to learn more about designating Algoma University as the beneficiary of your RRSP or RRIF funds and to determine if this option is appropriate for you.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

Gifts of securities (publicly-traded securities such as stocks, bonds, mutual funds or employee stock option shares) can be a very attractive way to make a gift to Algoma University. In 2006 the Federal Government eliminated the capital gains tax on gifts of publicly traded securities to registered charities. Significant tax savings could be yours when you make a gift of securities to Algoma University.

As a donor:

- You will receive a charitable tax receipt for the fair market value of the gift of securities. Value is determined by the price of the security on the closing date when the gift is received by Algoma University.

- Your capital gains tax could be eliminated when you make a gift of securities to Algoma University.

- If you donation exceeds your eligible amount for a tax credit, in the year you make the gift, you can carry forward your tax credit for up to five years.

Gifts of securities should be made in consultation with your professional advisors. Find out how you can make a significant gift to Algoma University and receive considerable tax savings.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

If you are 65 or older and want to make a significant donation to Algoma University but you still require the income from your assets, than exploring the benefits of a charitable remainder trust as part of your estate plan may be an option you wish to consider. A charitable gift annuity allows you to give a gift, save tax and increase your income.

Contact your professional advisors to find out how establishing a charitable gift annuity can help you to secure a stream of income, while making a significant contribution to Algoma University.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

Charitable Remainder Trusts provide you with an alternative to leaving a bequest in your will – and there are immediate tax benefits. With a Charitable Remainder Trust you can make a gift now, receive an immediate tax benefit, and continue to use or derive income from the asset for a specified number of years. When the specified term ends, the remainder is distributed to Algoma University, providing a legacy for the donor and having an impact for years to come.

Contact your professional advisors to determine if a charitable remainder trust is right for you.

Create your Legacy

A planned gift may be one of the most significant gifts you will make in your lifetime. Your commitment to excellence in education can continue with a gift that is planned today to prepare for the future. Please consider discussing with your professional advisors today how you can plan to maintain your legacy and commitment to Algoma University.

If you have already made arrangements to make a planned gift to Algoma University, please let us know so we can ensure the proper administration of your thoughtful gift intention.

Contact our Strategic Advancement and Alumni Affairs Office to learn more about how you can leave your legacy and possibly receive considerable tax benefits.

To learn more on how you can leave your legacy, and possibly receive considerable tax benefits please contact our Gift Planning Office.

A bequest or planned gift can be a thoughtful and impactful way of approaching your support for Algoma University and future generations of students. If you are considering making plans in your estate, please do not hesitate to contact Giselle Chiarello, Manager of Advancement for further details. (705) 949-2301 ext. 4125 or by email: [email protected]

All information is kept confidential.

This information is simply a general overview of planned giving options. When you make your decision, always seek appropriate financial or legal advice.

Meet the Team

"*" indicates required fields

Varsity Athletics: Adopt-A-Thunderbird

Adopting an Algoma U Thunderbird allows alumni, friends, family, and the community the opportunity to support our student athletes. Your generous donation has a direct impact on the quality of the program, strengthening our commitment to excellence in athletics, enhancing the experience for our student athletes, and helping to build our future leaders.

Algoma University student athletes work hard and make considerable sacrifices to maintain their academic standing while training and competing in their respective sport. Each year student athletes log thousands of kilometres and many long hours traveling to and from competitions across Ontario, Canada and the United States. For more information, view our Adopt-A-Thunderbird Brochure (PDF).

Adopt Now